Unlock Your Financial Future: Personal Finance Statistics 2023 Revealed – Take Action Now!

Personal Finance Statistics 2023: A Glimpse into the Future of Financial Management

Introduction

As we approach the year 2023, personal finance has become an increasingly important aspect of our lives. With the ever-changing economic landscape and the rise of technology, it is crucial for individuals to stay informed and make wise financial decisions. In this article, we will delve into the personal finance statistics for 2023 and explore the trends, challenges, and opportunities that lie ahead.

2 Picture Gallery: Unlock Your Financial Future: Personal Finance Statistics 2023 Revealed – Take Action Now!

What is Personal Finance Statistics 2023?

Image Source: millennialmoney.com

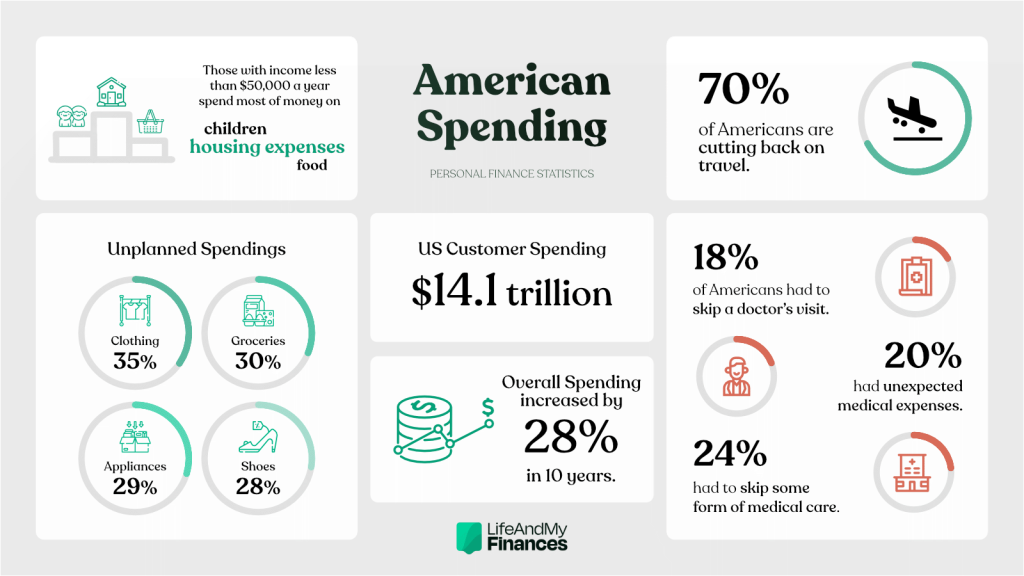

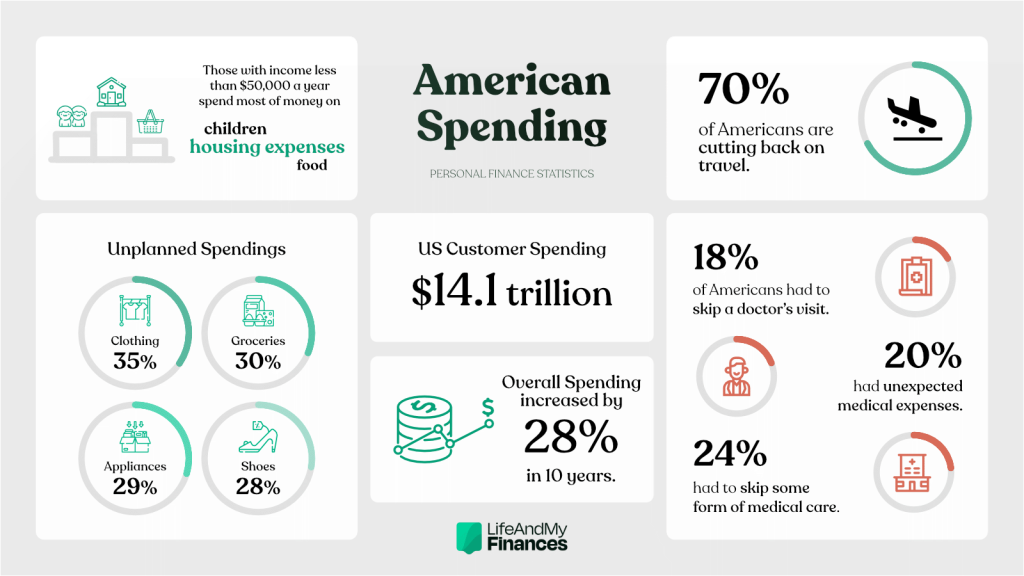

Personal finance statistics 2023 refers to the projected data and trends related to individuals’ financial management and decision-making. It encompasses various aspects such as income, expenses, savings, investments, debt, and financial goals. The statistics provide valuable insights into the state of personal finances and help individuals make informed choices to achieve financial well-being.

Who is Affected by Personal Finance Statistics 2023?

Every individual, regardless of age, income level, or occupation, is impacted by personal finance statistics 2023. Whether you are a young professional just starting your career, a parent saving for your children’s education, or a retiree planning for a secure future, understanding and adapting to the changing financial landscape is crucial for everyone.

Image Source: ctfassets.net

When and Where to Expect Personal Finance Statistics 2023?

Personal finance statistics 2023 will be available through various sources such as government reports, financial institutions, research organizations, and online platforms. These statistics will be released periodically throughout the year, providing individuals with up-to-date information to guide their financial decisions. Additionally, financial experts and bloggers will analyze and interpret the data, offering valuable insights and advice.

Why Personal Finance Statistics 2023 Matter?

Personal finance statistics 2023 matter because they provide individuals with a comprehensive understanding of the current and future state of personal finances. By staying informed about trends and projections, individuals can make proactive financial decisions, identify potential risks, and seize opportunities. These statistics help individuals set realistic goals, create effective budgets, manage debt, save for emergencies, plan for retirement, and achieve financial stability.

How to Utilize Personal Finance Statistics 2023?

To utilize personal finance statistics 2023 effectively, individuals need to incorporate them into their financial planning and decision-making processes. By analyzing the data and trends, individuals can identify areas of improvement, allocate resources wisely, identify potential investment opportunities, and adjust their strategies accordingly. Utilizing these statistics in conjunction with financial tools and technology can empower individuals to make informed choices and secure their financial future.

FAQs about Personal Finance Statistics 2023

1. Will personal finance statistics help me improve my financial situation?

Absolutely! Personal finance statistics provide valuable insights into financial trends and behaviors, helping individuals identify areas for improvement and make better financial decisions.

2. Where can I access personal finance statistics 2023?

Personal finance statistics 2023 can be accessed through various sources such as government websites, financial institutions, research organizations, and online platforms.

3. How often are personal finance statistics updated?

Personal finance statistics are typically updated periodically throughout the year. It is essential to stay up-to-date with the latest data and trends to make informed financial decisions.

4. Are personal finance statistics relevant for individuals of all income levels?

Yes, personal finance statistics are relevant for individuals of all income levels. Regardless of your income, understanding financial trends and adopting effective money management strategies is crucial for long-term financial well-being.

The Pros and Cons of Personal Finance Statistics 2023

Pros:

– Provides valuable insights into financial trends and projections

– Helps individuals make informed financial decisions

– Guides individuals in setting realistic financial goals

– Assists in budgeting, debt management, and savings strategies

– Identifies potential investment opportunities

Cons:

– Data may be subject to interpretation and analysis

– Statistics may not cater to individual circumstances

– Overreliance on statistics may overlook personal financial goals and values

– External factors may impact the accuracy of projections

Conclusion

In conclusion, personal finance statistics 2023 play a vital role in helping individuals navigate the complex world of finance. By staying informed and utilizing these statistics effectively, individuals can make informed decisions, set realistic goals, and achieve long-term financial well-being. Whether you are a novice or an experienced investor, incorporating personal finance statistics into your financial planning is key to securing a prosperous future. So, embrace the power of personal finance statistics 2023 and take control of your financial destiny.

This post topic: Personal Finance