Revolutionize Your Finances With The Best Personal Finance Software In New Zealand – Take Control Of Your Money Today!

Personal Finance Software New Zealand: A Comprehensive Review

Introduction

Managing personal finances can be a daunting task, especially when it comes to budgeting, tracking expenses, and planning for the future. However, with the advancements in technology, personal finance software has emerged as a powerful tool to simplify this process and empower individuals to make informed financial decisions. In this article, we will delve into the world of personal finance software in New Zealand, exploring its features, benefits, and drawbacks.

3 Picture Gallery: Revolutionize Your Finances With The Best Personal Finance Software In New Zealand – Take Control Of Your Money Today!

What is Personal Finance Software?

Image Source: zohowebstatic.com

In simple terms, personal finance software is a digital solution that helps individuals manage their money. It allows users to track income and expenses, create budgets, set financial goals, and monitor progress towards those goals. With the ability to synchronize bank accounts and credit cards, this software provides real-time updates on financial transactions, eliminating the need for manual data entry.

Who Can Benefit from Personal Finance Software?

Personal finance software is designed for individuals of all ages and financial backgrounds. Whether you are a young professional seeking to establish a solid financial foundation or a retiree aiming to make the most of your savings, this software can cater to your needs. It provides a comprehensive overview of your financial health and offers actionable insights to improve your financial well-being.

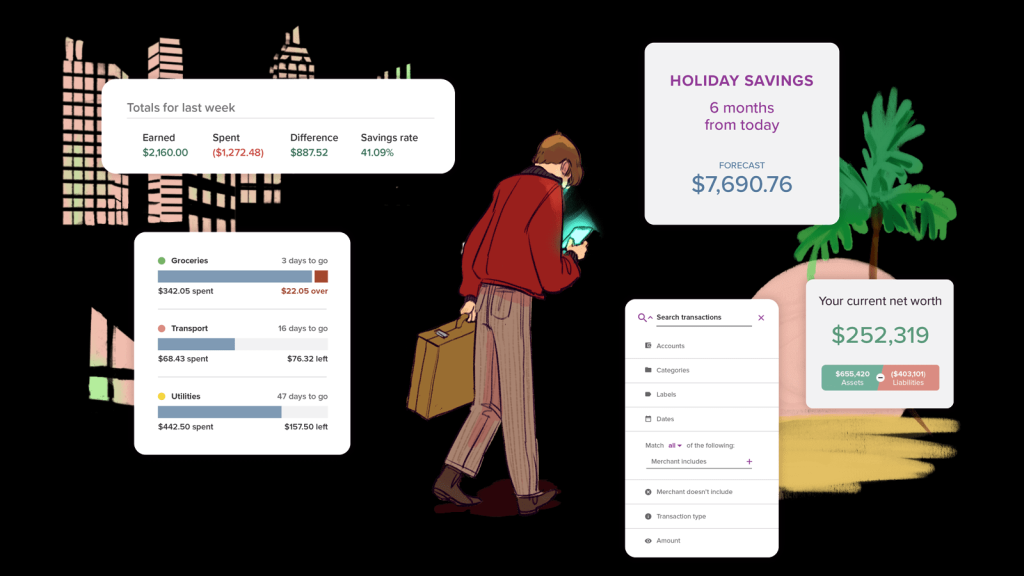

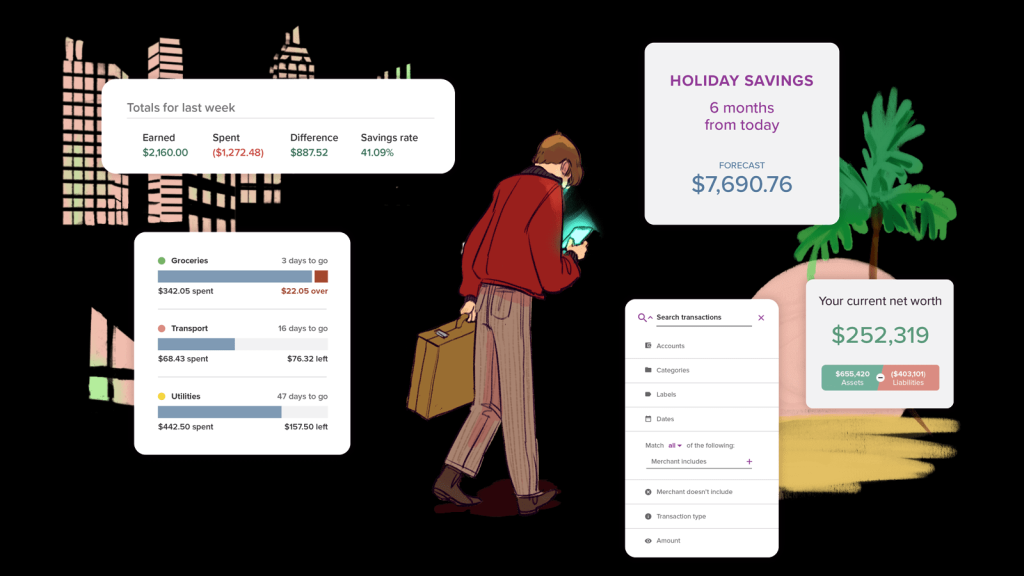

Image Source: valueadders.com.au

When Should You Start Using Personal Finance Software?

The ideal time to start using personal finance software is as soon as you begin earning money. By implementing these tools early on, you can develop good financial habits and avoid common pitfalls. However, it is never too late to start. Even if you have been managing your finances manually, personal finance software can streamline the process and provide a more accurate picture of your financial status.

Where Can You Find Personal Finance Software in New Zealand?

Image Source: pocketsmith.com

Fortunately, personal finance software is widely available in New Zealand. You can access it through various channels, including online platforms, mobile applications, and software downloads. Many banks and financial institutions also offer their own versions of personal finance software, tailored to their customers’ needs.

Why Should You Use Personal Finance Software?

There are several compelling reasons to start using personal finance software:

Budgeting Made Easy: Personal finance software simplifies budget creation and tracking. It categorizes expenses, identifies spending patterns, and provides visual representations of your financial situation.

Expense Tracking and Management: With personal finance software, you can effortlessly monitor your expenses and identify areas where you can cut back. It offers insights into your spending habits and helps you make data-driven decisions.

Goal Setting and Progress Tracking: Whether you want to save for a vacation, pay off debt, or invest in a retirement plan, personal finance software allows you to set goals and track your progress towards achieving them.

Financial Education and Insights: Personal finance software often includes educational resources and tools to improve financial literacy. It provides tips and tricks to maximize savings, reduce debt, and make smart investment decisions.

How to Choose the Right Personal Finance Software for You?

Choosing the right personal finance software can be a daunting task, given the plethora of options available. Here are a few factors to consider:

Features and Functionality: Assess your specific needs and choose software that offers the necessary features. Look for tools that align with your financial goals and provide ease of use.

Compatibility: Ensure that the software is compatible with your devices and operating systems. Look for cloud-based solutions that allow you to access your financial data from anywhere.

Security and Privacy: Personal finance software deals with sensitive financial information. Therefore, it is crucial to choose software that prioritizes data security and offers encryption and multi-factor authentication.

Customer Support: Consider the level of customer support offered by the software provider. Look for resources such as tutorials, forums, and responsive customer service to address any concerns or difficulties.

Frequently Asked Questions (FAQ) Regarding Personal Finance Software New Zealand

Q: Is personal finance software safe to use?

A: Personal finance software is designed with robust security measures to protect your financial data. However, it is essential to choose reputable software providers and follow best practices in securing your devices and passwords.

Q: Can personal finance software automatically categorize my expenses?

A: Yes, most personal finance software utilizes machine learning algorithms to automatically categorize expenses. However, manual categorization may still be required for certain transactions.

Q: Can I access personal finance software on multiple devices?

A: Yes, many personal finance software solutions offer multi-device access. This enables you to manage your finances seamlessly across your smartphone, tablet, and computer.

Conclusion

Personal finance software has revolutionized the way individuals manage their money in New Zealand. With its user-friendly interfaces, powerful features, and real-time financial insights, these tools empower users to take control of their financial well-being. By choosing the right software and implementing it into your financial routine, you can make informed decisions, achieve your goals, and secure a brighter financial future.

This post topic: Personal Finance