Unlock Your Ideal Investment Strategy Near Retirement: Secure Your Financial Future Now!

Investment Strategy Near Retirement: Preparing for a Secure Future

As retirement approaches, it is crucial to have a well-planned investment strategy in place to ensure a secure financial future. With the right approach, individuals can maximize their savings, minimize risks, and enjoy a comfortable retirement lifestyle. In this article, we will delve into the world of investment strategy near retirement, exploring the what, who, when, where, why, and how of this important topic.

What is Investment Strategy Near Retirement?

Investment strategy near retirement refers to the careful selection and allocation of assets in order to generate income and preserve capital as individuals approach their retirement years. This strategy takes into account factors such as the timeframe until retirement, risk tolerance, and financial goals. The aim is to create a diversified portfolio that balances risk and return to provide a stable income during retirement.

3 Picture Gallery: Unlock Your Ideal Investment Strategy Near Retirement: Secure Your Financial Future Now!

Who Should Consider an Investment Strategy Near Retirement?

Anyone who is nearing retirement age or has a short time horizon until retirement should consider implementing an investment strategy tailored to their specific needs. This includes individuals who have diligently saved for retirement, those who are relying on pensions or 401(k) plans, and even those who have not yet started saving but want to catch up before retiring.

When Should You Start Planning Your Investment Strategy Near Retirement?

Image Source: annuityexpertadvice.com

It is never too early to start planning for retirement. However, as retirement draws nearer, it becomes increasingly important to fine-tune your investment strategy. Ideally, individuals should begin reviewing their investment portfolio and considering adjustments around five to ten years before their planned retirement date.

Where Can You Seek Professional Help for Your Investment Strategy Near Retirement?

Seeking professional advice is highly recommended when planning your investment strategy near retirement. Financial advisors or retirement planners can provide valuable insights, assess your individual needs, and help develop a customized investment plan. They have the expertise to guide you through the complexities of retirement planning and ensure that your investments align with your goals.

Why is Investment Strategy Near Retirement Important?

Having a solid investment strategy near retirement is crucial for several reasons. First and foremost, it allows individuals to secure their financial future and maintain their desired lifestyle during retirement. Additionally, it helps protect against market volatility and unexpected events that could impact savings. By diversifying investments and balancing risk, individuals can minimize potential losses and optimize returns.

How Can You Develop an Effective Investment Strategy Near Retirement?

Image Source: squarespace-cdn.com

Developing an effective investment strategy near retirement involves several key steps. Firstly, individuals need to assess their current financial situation, including their savings, expenses, and potential sources of income in retirement. Next, they should determine their risk tolerance and investment objectives. Based on this information, they can then create a diversified portfolio that aligns with their goals, taking into account factors such as asset allocation, retirement income needs, and tax considerations.

Frequently Asked Questions

Q: What are the key factors to consider when developing an investment strategy near retirement?

A: Some key factors to consider include your risk tolerance, desired retirement lifestyle, investment goals, time horizon, and potential sources of income in retirement.

Q: Is it possible to change my investment strategy near retirement?

A: Yes, it is possible to make adjustments to your investment strategy near retirement. However, it is important to consult with a financial advisor to ensure that any changes align with your goals and do not jeopardize your financial future.

Q: Should I rely solely on stocks for my investment strategy near retirement?

Image Source: gitnux.com

A: While stocks can offer higher returns, they also come with higher risks. It is recommended to have a diversified portfolio that includes a mix of stocks, bonds, and other assets to balance risk and potentially increase income stability.

Conclusion

Planning your investment strategy near retirement is a crucial step towards achieving a financially secure future. By carefully considering your goals, risk tolerance, and time horizon, you can create a diversified portfolio that generates income and protects your capital. Seeking professional advice and regularly reviewing your strategy will help ensure that you stay on track and enjoy a comfortable retirement lifestyle. Start planning now and make the most of your retirement years.

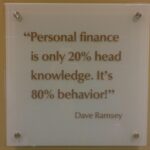

This post topic: Personal Finance