Mastering The Ultimate Investment Strategy: Long And Short – Unleash Your Profits Now!

Investment Strategy Long and Short: Maximizing Returns and Minimizing Risks

Investment strategy long and short is a popular approach used by investors to optimize their portfolio returns while simultaneously managing risks. This strategy involves taking both long positions, betting on the rise of certain assets, and short positions, betting against the decline of others. By diversifying investments and leveraging market trends, investors can potentially generate significant profits regardless of market conditions.

What is Investment Strategy Long and Short?

Investment strategy long and short is a combination of two investment strategies: long positions and short positions. Long positions refer to buying assets with the expectation that their value will increase over time. On the other hand, short positions involve borrowing assets and selling them, with the intention of buying them back at a lower price in the future. This strategy allows investors to profit from both upward and downward movements in the market.

3 Picture Gallery: Mastering The Ultimate Investment Strategy: Long And Short – Unleash Your Profits Now!

Who Can Benefit from Investment Strategy Long and Short?

Investment strategy long and short is suitable for experienced investors who are willing to take calculated risks in pursuit of higher returns. It requires a deep understanding of market dynamics and the ability to identify trends and potential opportunities. While this strategy can be profitable, it is important to note that it also carries a higher level of risk compared to more conservative investment approaches.

When and Where to Implement Investment Strategy Long and Short?

Image Source: slideteam.net

Investment strategy long and short can be implemented in various markets, including stocks, bonds, commodities, and currencies. The timing of when to implement this strategy depends on market conditions and investor preferences. Some investors may choose to use it during periods of high volatility, while others may employ it as a long-term investment strategy. As for the location, this strategy can be applied globally, as long as the investor has access to the desired markets and assets.

Why Choose Investment Strategy Long and Short?

There are several reasons why investors choose investment strategy long and short. Firstly, it allows them to benefit from both rising and falling markets, providing potential profits in any market scenario. Secondly, this strategy offers increased diversification, as investors can allocate their capital across different assets and sectors. Lastly, by carefully managing risk, investors can minimize potential losses and protect their portfolio from adverse market conditions.

How to Implement Investment Strategy Long and Short?

Implementing investment strategy long and short requires a systematic approach. Firstly, investors need to conduct thorough research and analysis to identify potential investment opportunities. This involves studying market trends, analyzing financial statements, and monitoring economic indicators. Once potential investments are identified, investors can establish both long and short positions accordingly, based on their assessment of the assets’ future performance.

FAQ about Investment Strategy Long and Short

Q: Are there any specific requirements for implementing this strategy?

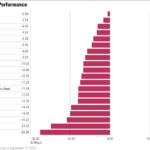

Image Source: wallstreetprep.com

A: While there are no specific requirements, it is essential to have a robust understanding of the assets being traded, as well as the ability to manage risk effectively.

Q: What are the potential benefits of investment strategy long and short?

Image Source: slideteam.net

A: The potential benefits include the ability to profit in both rising and falling markets, increased diversification, and risk management.

Q: What are the disadvantages of investment strategy long and short?

A: The main disadvantage is the higher level of risk involved compared to more conservative investment strategies.

Q: How do I determine the appropriate size of my long and short positions?

A: The size of long and short positions should be determined based on a careful assessment of risk tolerance, market conditions, and investment goals.

Pros and Cons of Investment Strategy Long and Short

Pros:

Potential for higher returns

Increased diversification

Ability to profit in any market condition

Cons:

Higher level of risk

Requires in-depth market knowledge

Can be more time-consuming

Conclusion: Leveraging the Power of Investment Strategy Long and Short

Investment strategy long and short is an effective approach for maximizing returns and managing risks. By combining long positions and short positions, investors can capitalize on market trends and generate profits in any market scenario. However, it is crucial to remember that this strategy requires a deep understanding of the market and careful risk management. With proper research and analysis, investors can leverage the power of investment strategy long and short to achieve their financial goals.

This post topic: Personal Finance