Unlock Your Potential With The Powerful Investment Strategy Leveraged Buyout – Take Action Now!

Investment Strategy Leveraged Buyout: Unlocking Potential through Financial Engineering

Have you ever wondered how companies acquire other businesses or finance large-scale projects? The answer lies in a powerful investment strategy known as leveraged buyout (LBO). In this article, we will delve into the intricacies of this strategy, exploring its purpose, process, and potential benefits. Whether you are an aspiring investor or simply curious about the world of finance, join us on this exciting journey as we unravel the mysteries of leveraged buyouts.

What is an Investment Strategy Leveraged Buyout?

At its core, a leveraged buyout (LBO) involves the acquisition of a company using a significant amount of borrowed money to finance the purchase. This strategy usually involves a combination of debt and equity, with the acquired company’s assets serving as collateral for the borrowed funds. The primary goal of an LBO is to generate significant returns on investment by restructuring the target company and improving its financial performance.

2 Picture Gallery: Unlock Your Potential With The Powerful Investment Strategy Leveraged Buyout – Take Action Now!

Who Utilizes Leveraged Buyouts?

Leveraged buyouts are often employed by private equity firms or individuals seeking to acquire a controlling stake in a company. Private equity firms typically raise funds from institutional investors, such as pension funds or insurance companies, to finance their investments. By leveraging their expertise and capital, these firms aim to enhance the value of the acquired company and ultimately generate substantial profits.

When and Where are Leveraged Buyouts Executed?

Image Source: webflow.com

Leveraged buyouts can occur in various industries and sectors, depending on market conditions and investment opportunities. While they are more prevalent during periods of economic prosperity, leveraged buyouts can also be executed during downturns or when undervalued assets become available. The global nature of financial markets means that leveraged buyouts can take place anywhere in the world, offering investors a wide range of potential opportunities.

Why Choose a Leveraged Buyout Strategy?

Investors choose the leveraged buyout strategy for several reasons. Firstly, it allows them to acquire companies with a relatively small upfront investment, as the majority of the purchase price is financed through borrowed funds. Additionally, the use of debt financing provides tax advantages, as interest payments on the debt can be tax-deductible. Moreover, by taking a controlling stake in the target company, investors can actively implement changes and drive the company’s growth and profitability.

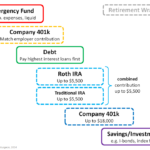

How Does the Leveraged Buyout Process Work?

The leveraged buyout process typically involves several stages. Firstly, an investor or private equity firm identifies a target company that aligns with their investment criteria. The investor then conducts due diligence to evaluate the target company’s financial performance, operations, and potential for growth. Once satisfied with the assessment, negotiations take place to agree on the purchase price and deal structure.

Image Source: investopedia.com

Next, the investor secures financing for the acquisition, often by reaching out to financial institutions or raising capital from investors. The borrowed funds comprise a significant portion of the purchase price, with the remaining amount funded through equity contributions. After completing the acquisition, the investor takes an active role in managing the company, implementing operational improvements, and optimizing its financial structure.

FAQ: Frequently Asked Questions about Leveraged Buyouts

Q: What are the risks associated with leveraged buyouts?

A: Leveraged buyouts carry inherent risks, primarily centered around the heavy reliance on borrowed funds. If the acquired company fails to generate sufficient cash flow to cover interest payments and debt obligations, it may face financial distress or even bankruptcy. Furthermore, economic downturns or unfavorable market conditions can negatively impact the performance and valuation of the target company.

Q: Are leveraged buyouts only suitable for large companies?

A: While leveraged buyouts are often associated with large-scale transactions, they can also be executed on smaller companies. However, the feasibility of an LBO depends on various factors, including the company’s financial stability, growth potential, and industry dynamics.

Q: How long does a leveraged buyout typically take to generate returns?

A: The timeline for realizing returns on a leveraged buyout investment can vary significantly. While some investors may achieve returns within a few years, others may require a longer timeframe to implement strategic initiatives and drive value.

The Pros and Cons of Leveraged Buyouts

Like any investment strategy, leveraged buyouts come with their own set of advantages and disadvantages. Let’s explore some of the key pros and cons:

Pros:

– Potential for high returns on investment if the target company’s performance improves significantly

– Ability to acquire companies and drive their growth without committing substantial upfront capital

– Tax advantages due to deductibility of interest payments

Cons:

– High levels of debt can increase financial risk, especially during economic downturns

– Limited liquidity, as the investor’s capital is tied up in the acquired company for an extended period

– Reliance on accurate financial forecasting and successful execution of strategic initiatives

Conclusion: Unlocking Potential through Leveraged Buyouts

Leveraged buyouts represent a powerful investment strategy that enables investors to acquire companies, drive growth, and create value. By utilizing a combination of debt and equity, this financial engineering technique offers the potential for substantial returns on investment. However, it is essential to carefully evaluate the risks and benefits associated with leveraged buyouts before embarking on such ventures. With the right expertise, diligence, and a well-executed plan, a leveraged buyout can unlock the hidden potential of a target company and pave the way for financial success.

This post topic: Personal Finance