Unleashing The Power: Investment Strategies Of Mutual Funds In India – Discover Your Winning Formula Now!

Investment Strategies of Mutual Funds in India: A Comprehensive Guide

Introduction:

Investing in mutual funds has become increasingly popular in India as individuals seek opportunities to grow their wealth and achieve financial goals. With a plethora of investment options available, it is crucial to understand the investment strategies employed by mutual funds in India to make informed decisions. This article aims to provide a comprehensive guide on the investment strategies utilized by mutual funds in India, highlighting their benefits, risks, and considerations for potential investors.

2 Picture Gallery: Unleashing The Power: Investment Strategies Of Mutual Funds In India – Discover Your Winning Formula Now!

What are Mutual Funds?

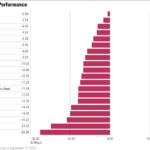

Image Source: rankmf.com

Mutual funds are investment vehicles that pool money from various investors to invest in diversified portfolios of stocks, bonds, and other assets. These funds are managed by professional fund managers who aim to generate maximum returns for investors while minimizing risks. Mutual funds offer individuals with limited knowledge or time to invest access to professionally managed portfolios and the potential benefits of diversification.

Who Manages Mutual Funds in India?

Mutual funds in India are regulated by the Securities and Exchange Board of India (SEBI) and managed by Asset Management Companies (AMCs). AMCs employ expert fund managers who analyze market trends, assess securities, and make investment decisions on behalf of investors. These fund managers play a crucial role in implementing various investment strategies to achieve the fund’s objectives.

Image Source: retirewise.in

When Should You Consider Investing in Mutual Funds in India?

Investing in mutual funds in India can be suitable for individuals with long-term financial goals, such as retirement planning, wealth creation, or funding education expenses. Mutual funds provide the potential for higher returns compared to traditional investment avenues like fixed deposits and savings accounts. However, it is essential to have a clear understanding of your risk tolerance and investment horizon before considering mutual fund investments.

Where Can You Invest in Mutual Funds in India?

Mutual funds in India can be purchased through various channels, including banks, online platforms, and independent financial advisors. Online investment platforms have gained popularity due to their convenience, ease of use, and comprehensive access to various mutual fund schemes. These platforms offer investors the flexibility to compare funds, track performance, and make informed investment decisions.

Why are Investment Strategies Important for Mutual Funds in India?

Investment strategies play a crucial role in determining the performance and potential returns of mutual funds in India. Fund managers employ various strategies based on market conditions, investment objectives, and risk appetite. These strategies may include growth-oriented investments, value investing, sector-specific allocations, or a combination of multiple approaches. Understanding the investment strategies employed by mutual funds helps investors gauge the suitability of a fund in their portfolio.

How Do Mutual Fund Investment Strategies Work?

Mutual fund investment strategies involve the selection and allocation of assets to achieve specific financial goals. Some common investment strategies employed by mutual funds in India include:

1. Growth Investing: This strategy focuses on investing in stocks of companies with high growth potential. It aims to generate capital appreciation over the long term.

2. Value Investing: Value investing involves identifying undervalued stocks with favorable growth prospects. Fund managers aim to generate returns by buying these stocks at discounted prices and holding them until their value is recognized by the market.

3. Asset Allocation: Asset allocation strategies involve diversifying investments across different asset classes, such as equities, bonds, and cash equivalents. This approach aims to balance risk and returns based on market conditions and investor preferences.

4. Sectoral Allocation: Some mutual funds concentrate their investments in specific sectors or industries. This strategy allows fund managers to capitalize on favorable market conditions in a particular sector but may expose investors to sector-specific risks.

FAQs about Investment Strategies of Mutual Funds in India:

1. Are mutual funds in India suitable for short-term investments?

While mutual funds can be invested in for the short term, they are generally more appropriate for long-term investment goals due to market volatility and potential fluctuations in returns.

2. Do all mutual funds in India follow the same investment strategies?

No, different mutual funds in India follow different investment strategies based on their fund objectives, risk profiles, and market conditions. It is essential to assess each fund’s investment strategy before investing.

3. How can I determine the risk associated with a mutual fund’s investment strategy?

The risk associated with a mutual fund’s investment strategy can be evaluated by analyzing its historical performance, volatility measures, and the types of assets it invests in. It is advisable to consult with a financial advisor for a comprehensive assessment.

4. Can I switch between different investment strategies within a mutual fund?

In most cases, investors cannot switch between investment strategies within a mutual fund. However, they can switch between different mutual fund schemes offered by the same AMC to align their investment strategy with changing financial goals.

Conclusion:

Investment strategies are crucial components of mutual funds in India, shaping their performance and potential returns. As an investor, understanding these strategies helps in making well-informed decisions and selecting funds that align with your financial goals and risk tolerance. Investing in mutual funds in India can offer individuals the opportunity to grow their wealth and achieve long-term financial objectives. However, it is essential to conduct thorough research, seek professional advice, and regularly review investments to optimize returns and mitigate risks.

This post topic: Personal Finance